Falling Down?

Amazon is in a deeper hole than it represents, and is still digging

Within Amazon, there is pride in founding ideals.

Zealous curiosity. Speed and simplicity free from encumbrance. Most of all, an intense red tape allergy encouraging a bold “fail fast” mentality free from unnecessary administrative entanglement.

Jeff Bezos baked these “Day 1” qualities deep into his company. They were his chosen defense against the restless of march of Day 2, which is Amazon parlance for an irrecoverable bureaucratic infection certain to slowly kill any innovative enterprise.

But in the three years since the pandemic ended and Bezos stepped back, many have questioned whether Amazon has wandered into Day 2. I count myself among them.

But I’m here to tell you it’s not Day 2. We are actually way past that now. The infection has metastasized, its symptoms skillfully masked. Lethal damage has been done.

The evidence suggests we’re now in what we might call Day 3. End stage Amazon.

That will sound outlandish to most people. The world sees this company as an invincible global juggernaut with a planetary market cap and more power than God. We imagine Amazon as an intergalactic conglomerate which will one day build our spaceships, mint our currency, slice our bread, and even think for us.

But I have come to believe the company is a paper tiger. A crater waiting to be named.

Amazon struts around wearing the belt of a world champion. But behind the twinkle of its gold-encrusted buckle is a prize fighter knocked cold as a mackerel but still standing. Throwing dazed punches in the air that reveal brute strength with neither aim nor coherence.

I believe that some day sooner than the conventional wisdom would have us believe, it will topple to the canvas. Only then will everyone realize in retrospect how wobbly its gait had been.

As that reality dawns, the money providing Amazon’s sole remaining raison d'être will drain out, leaving only the exsanguinated corpus of a once mighty champion.

Because in words befitting a company which once converted old doors into desks, this is the end, beautiful friends.

Some will say I am wish casting.

Perhaps they have a point. I do yearn for my former employer to be accountable. As an influential employer, Amazon has made outsized contributions to the decay and decrepitude of the modern workplace. I see the company showing disloyalty to everyone and everything that made it great.

But my bias, which I stipulate, doesn’t by itself make me wrong. So bear with me while I explain, because it will be entertaining if nothing else.

And as you do, bear in mind something else: the black magic of fiduciary duty gives publicly held corporations a license to conceal anything which might harm share price.

Which means no corporation will ever admit it is verging on collapse.

Only when denial is no longer possible will it admit.

So I shall proceed with illustrating why I believe this prize fighter is about to take a dive. It will be up to you to decide the extent to which I have a point, and the extent to which you will act on it.

Like any good doomsday story, mine has four horsemen. Though in this scenario, I imagine them riding jackasses.

Each represents a relationship vital to Amazon’s survival which has been effectively destroyed by the company’s actions. As a result, it is increasingly isolated and dissolute, hemmed into a box by myopic and dubious decisions lacking strategic sensibility.

The result is a multi-axis battle it cannot win. And much of that battle is being fought in the courts.

Federal Trade Commission v. Amazon, Part 1

Suing Amazon is becoming its own industry. Legions are amassing. And lawyers are a bit like pigeons. They gather where crumbs are easily pecked, leaving a shitty mess behind.

Dozens of lawsuits are being filed against Amazon in state and federal courts every month, and the rate of filings is accelerating.

Litigants range from private suppliers to consumers to governments. In the UK, a law professor is leading a class action alleging unlawful marketplace extortion tactics to the tune of $3.6B in damages. You know it’s open season when the academics start lacing up their spikes.

But this jackass is jockeyed by the US Federal Trade Commission (FTC). In a suit since joined by the attorneys general of 18 states, the FTC alleges Amazon

“is a monopolist that uses a set of interlocking, anti-competitive, and unfair strategies to illegally maintain its monopoly power.”

The suit outlines an assortment of dirty tactics employed by Amazon to artificially limit competition, erode the value proposition for customers, and lock third-party sellers into its platform.

These things are all unlawful and wrong. But the real whopper for Amazon is the specific allegation of price-fixing.

The reason you find what you’re looking for on Amazon is because millions of small businesses sell their goods on the platform. But they also sell elsewhere, like Walmart.com or Google Shopping. When Amazon started imposing higher fees on its sellers, some of them chose to raise their prices on Amazon to recover some of that cost.

But Amazon then enforced something called a price parity clause. This is a rule in its standard merchant agreement stating that a seller must offer its lowest price on Amazon — it cannot offer a lower price somewhere else.

When sellers broke this rule, Amazon demoted their visibility on the site, cratering their sales and threatening their solvency. Some lost their businesses.

With this practice, Amazon didn’t just bully its own suppliers. It inflated the costs of goods on other sites, which prevented customers getting the best deal. It raised the cost of goods sold for numerous businesses, leaving them less able to operate and innovate. And it prevented other retailers from competing on fair terms.

Whoever decided to include and enforce a price parity clause in Amazon’s seller agreement embedded an illegal flaw into its entire business model.

The financial exposure for Amazon in this suit could be as high as $200B, which explains why the company has been hoarding cash and catastrophizing over cost controls amid record profits and share prices.

Amazon is of course contesting the suit. As I was writing this piece, a federal judge dismissed some of the allegations, though the details are not yet clear as the order is temporarily under seal to permit redactions.

We won’t know for a few weeks which FTC claims will proceed.

But my guess is Amazon will not overplay its public resistance to the suit, and might be motivated to settle out of court the claims which have survived. Because the details revealed in contesting the case could create criminal exposure.

Price-fixing is a hardcore anti-trust violation punishable by a decade in prison and a $500,000 fine. Doing so using an interstate communications network is wire fraud, which triples the prison term.

Amazon is alleged to have used an algorithm to determine when its sellers were offering a better deal on a rival website. The existence of that algorithm means an executive directed its creation and approved its implementation. That implies corporate fingerprints on a potential criminal act committed millions of times.

The scale of Amazon is so massive that if a prosecution was ever brought, the fines alone would be capable of consuming the company’s market cap many times over.

That’s unlikely. But the material damage is already done. With harsh fees and heavy-handed tactics, Amazon has alienated the seller network that made it great.

Representing itself as a champion of mom-and-pop shops, the retailer exploded the selection available in its online store by welcoming them with open arms. Once it had them addicted to its services, their business models assuming a reasonable cost structure, it started the squeeze play.

Today, Amazon’s seller pricing model includes not just the standard 15% “referral fee” it has always collected for every item sold by a third party. It also charges fulfillment fees to subsidize its transportation and packaging costs. It also charges an advertising fee to subsidize its advertising costs.

When these fees are tallied up, Amazon’s cut of the revenue from every unit sold is now more than 50%. The mind boggles.

Let’s say you own a supermarket. Your customers want bananas, and I have bananas to sell. You agree to sell them in your store for $1 each and I agree to give you 15 cents for every banana sold. We shake hands. You are very welcoming and accommodating, someone I want to work with. I start selling most of my bananas in your store. I build a customer base. I become reliant on the revenue to fund my banana operation. I make financial commitments and investments based on our agreement.

Then one day, you tell me you’ll be taking 50 cents for every banana. I tell you that’s fine, but I’ll have to raise prices to stay profitable. You tell me I can’t do that because you need to offer the lowest prices in town. You threaten to ban me and my bananas from your store if I raise my prices.

I realize this has all been monkey business. A classic trap and squeeze. You were flattering to deceive. Now you’re taking money out of my pocket and putting into your own pocket. With impunity. So I comply, knowing you will likely reward me by taking an even greater cut next year.

There is no universe outside of the mob movie genre where this is reasonable, or fair, or sustainable. But it is an accurate heuristic for what Amazon is doing to its sellers.

Sellers now pay roughly double the fees paid in 2016. And yes, fees have risen on other platforms as well. But Amazon stands alone in its attempt to control seller reactions to fee hikes with threats and coercion.

Sellers may not be able to immediately leave Amazon. They’ve built their customer base on the platform and are prisoners to its tactics until they can position themselves to migrate or defy. But a captive seller network is a ticking time bomb. When it detonates, Amazon’s sales model will be threatened.

Because make no mistake, the $140B in seller fees collected annually by Amazon are the reason it can continue to beat competitors on price while offering fast shipping. It is dependent on those fees. Which is why it needs to impersonate the mafia to keep them flowing.

This gestures toward a broken business model. And the money to fix it is being pecked and slurped down the hungry gullets of those pigeons I mentioned earlier.

As more pigeons take note, Amazon could become the Trafalgar Square of online retail.

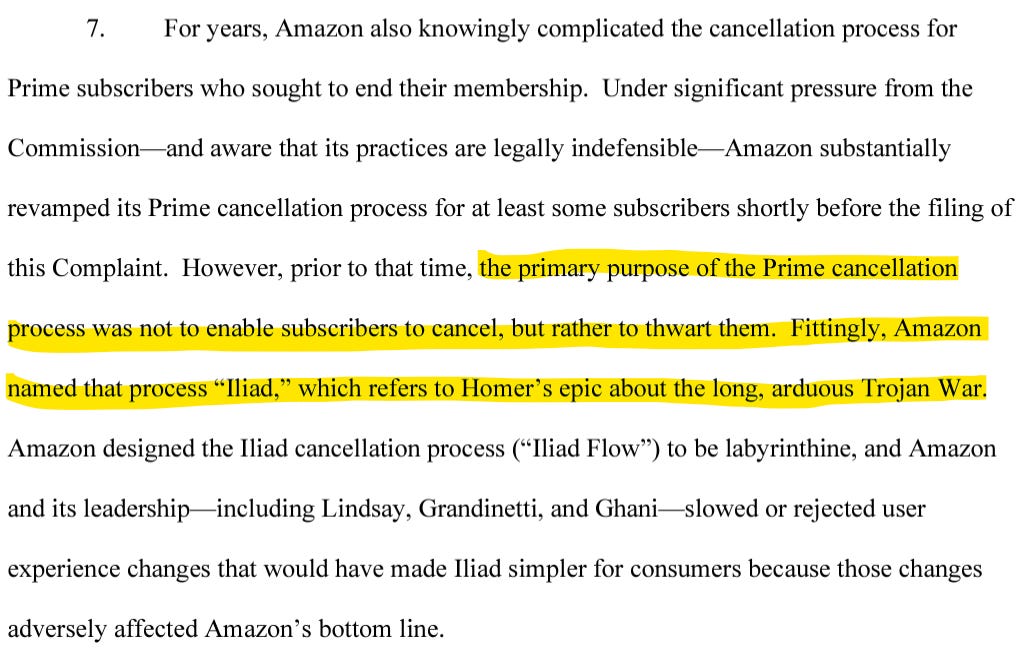

FTC v. Amazon, Part 2

In a separate lawsuit, the FTC says Amazon used

“manipulative, coercive or deceptive user-interface designs known as 'dark patterns' to trick consumers into enrolling in automatically renewing Prime subscriptions.”

FTC claims Amazon knew a percentage of signups were accidental but welcomed the revenue anyway. Many users paid hollow subscription fees for months before successfully cancelling.

The scheme duped millions into buying something they didn’t intend. But the real chicanery started once they figured it out and tried to unsubscribe.

FTC says Amazon implemented an unlawful digital maze to prevent shoppers from quitting Prime.

I’ve highlighted a key excerpt from the Commission’s complaint.

Students of Enron’s collapse will recall how the company throttled electricity supply in California, creating rolling power outages to artificially inflate demand, rake more revenue, and pressure municipal governments into deals.

Recorded conversations between executives caught them using demeaning language to poke fun at utility customers left in the dark by the greed they wielded with impunity.

The situation was profane.

And so is my assessment of the attitude toward customers reflected in this suit. It is Enron-level fuckery.

That a process designed to swindle and frustrate customers by tossing their wallets into the tall weeds could exist within Amazon demonstrates it is not the respectable company it represents itself to be.

That such a process could be named after a Homeric trial designed to exhaust customers into submission reflects a cultural disdain for customers. This kind of corruption can only thrive in environments cultivated and led by individuals wielding commercially fatal levels of arrogance and stupidity.

The existence of Iliad should have resulted in sacked executives. Instead, Amazon has portrayed them as victims whose “lives have been upended by the FTCs baseless and unjust allegations.”

It’s rare to spot such uncut corporate narcissism in the open.

If this lawsuit needed an emblem, a flaming sack of excrement would just about do. But let’s see if we can discern a few conclusions in if/then form.

If Amazon really believed the suit was baseless, then it wouldn’t have removed dark patterns from its Prime signup and Prime quit processes.

If the evidence in the FTC complaint is accurate, then Amazon is no longer a customer centric company. It has abandoned the core value which gave it an identity. It has turned on its customers, who it needs to survive. Which means it is lying every time it pretends to the contrary, and therefore cannot be considered a trustworthy company either.

If your business model requires hoodwinking people into accidentally paying you for something they didn’t mean to buy, then you’re not running a business. You’re running a scam.

If you only stick to your principles when it’s cost-free, then you have no principles.

If you have no respect for the people whose patronage keeps the lights on, then you’re not in business. You’re running a digital fleece. An advanced method of mass pick-pocketing.

The fact Amazon wears a two trillion dollar beard can’t disguise the pocked ugliness this suit reveals. “Earth’s most customer centric company” sees customers as a source of cash, not counterparts in a relationship.

Things like “Iliad Flow” don’t materialize in a company that sees customers as the reason for its existence, as Amazon has always claimed.

But if Amazon is not about customers, then what is it about? The more I look, the more convinced I become that the answer is simply survival.

The Prime lawsuit again suggests a business model so far off the mark that crazy decisions seem rational to executives. Like continuing, even after employees have raised ethical concerns, an unlawful process to protect Prime subscription revenue.

Something is not adding up. And rather than confront it and take the lumps necessary to reset and rebuild, it seems the company is tearing every tendon in a mad stretch to conceal the nature of whatever flaws exist.

Stretching to cover a bad business model and keep investment flowing is exactly how Enron morphed incrementally from a troubled company to a bankrupt criminal gang.

National Labor Relations Board v. Amazon

Earlier this year, a federal judge found Amazon CEO Andrew Jassy had violated labor law by using coercive language to dissuade employees from joining unions.

It’s one in a string of legal setbacks in Amazon’s notorious opposition to organized labor. It’s already been found culpable for unlawful retaliation and tampering with the union voting process.

Amazon says it wants a direct conversation with employees. But on the issues that matter most to employees, communication is one-way, and occurs at the time and place of management’s choosing. Decisions are top-down, centralized, and not open for debate.

Jassy’s recent mandate for a full return to physical offices sparked a collective “can we talk about this” from tens of thousands of employees whose lives have been upended. Like sellers squeezed by fee hikes, these employees reasonably relied on Amazon’s assurances and built their lives around remote work.

Now Jassy is altering the deal, and refusing to comment or discuss publicly or internally.

So much for a direct conversation.

Jassy’s breach of labor law is symbolic of Amazon’s broken relationship with its workforce.

The company lays off workers without even seeking to understand the operational impact. It does so by ambush, wrecking the psychological safety of those left behind. You don’t do that when you value people.

It freezes pay after record profits. It uses talent appraisals to declare individuals struggling performers so it can manage them out in a back-door layoff as inhumane as it is dishonest. And then does the same thing again the next year. You don’t do these things when you genuinely hope to be “Earth’s Best Employer.”

Micromanagement and red tape have become features instead of bugs in a culture of monitoring and control. Time pressure and unhealthy stress are everywhere. Staff cuts stretch everyone on the rack. “More with less” is weaponized to constantly question the necessity of every human role.

Barriers to promotion have multiplied and timelines have stretched as the company went from a scrappy environment where hustle was rewarded to a process-driven bureaucracy with a stratospheric ivory tower.

Authority looms large in every node of the company, shutting down dialogue and dampening disagreement. All the while, fears of further layoffs lurk.

Not surprisingly, innovation is dead. As the great Lemm Sissay has counseled, “imagination cannot be afraid.” So when you let fear prevail, you kill creativity.

But these are all subjective and arguable elements of company culture. To find the pathology, we must follow the slime trail back to unionization.

It’s been reported in the UK that Amazon hired hundreds of workers into one of its warehouses to dilute support for an impending union vote. If true, this reeks of desperation and is a much bigger story than the reporting would suggest.

Amazon’s fulfillment network hires labor to meet demand. The demand in a particular warehouse is a function of the inventory it holds, its proximity to the customers who place orders, and the configuration of shipping connections carrying parcels to their destinations. By leveling demand and labor in every warehouse, and by placing the right inventory volume and selection in each location, Amazon achieves the lowest shipping cost at the lowest labor expense. This is key to offering low prices.

Hiring labor into a warehouse for any reason other than demand will either result in labor excess to demand, or will trigger the artificial reassignment of orders at a higher cost to serve.

Either way, it’s a damned expensive manipulation. In my time with the company, suggesting artificial demand assignment to a particular warehouse was a great way to get publicly castigated and ridiculed for not understanding the basics of cost control.

So if this is what Amazon has done, it is seriously afraid of what unionization would do to its cost structure. And thus, its business model.

When I step back and look at Amazon’s alleged union-busting tactics, it calls to mind a salted slug. It’s crawling along, feeling the pain and in touch with its eventual doom. But determined to keep muscling along until it can’t anymore.

Think about it. Amazonians are inching closer to unionizing. The proper response is to address their concerns with a direct conversation. Provide the improvements in pay and working conditions they seek. Neutralize momentum toward unionization. Instead, Amazon seems to be employing the dark arts. Which tells me it cannot afford to come to the table and discuss even modest concessions.

It feels less like a clear-eyed choice and more like an amygdala-driven survival move.

To become existentially threatened by workers gaining leverage (or more precisely, realizing and harnessing the leverage they already have) when you’re a market-leading retailer paying market-mediocre wages can only mean one thing.

That your business model is built on the assumption of lower labor costs than you can sustain. Or more precisely, than you can sustain without NDA-enabled, PR-lubricated skullduggery.

It’s clear Amazon doesn’t believe it’ll be profitable if workers secure higher pay and better conditions. It sees a union movement as an existential threat. This means workers have a lot more leverage than they think, and that the labor costs assumed in Amazon’s business model are deeply and perhaps fatally risky.

Consumer Product Safety Commission v. Amazon

Here’s a snip from the section of Amazon’s public site where it discusses safety. Have a quick look. There are two things I want you to notice, one I’ve made obvious and the other is more subtle.

The fact Amazon has spent $1B on safety initiatives in 5 years sounds like a lot. Objectively, it is a lot.

But considering the scale of the company, it is somewhere between peanuts and pittance.

Amazon’s revenue for 2023 was in excess of $575B. Which means that of the money which came through the door, about three one hundredths of a percent was reinvested into safety. For contrast, Amazon has invested $293B into research and development in the past 5 years, including about 15% of its revenue total for 2023. Which means R&D is considered 400 times more important. Safety is a rounding error.

But what’s most striking is what isn’t on this chart: any mention of product safety or consumer safety. This is not to suggest Amazon doesn’t care about or tend to these aspects of safety. But their omission from its public-facing safety messaging is telling us something about the priority of these things in the corporate psyche.

Which brings us to a Consumer Product Safety Commission (CPSC) action from earlier this year.

After a complaint was raised claiming Amazon was knowingly selling hundreds of thousands of unsafe third-party goods, CPSC responded by insisting Amazon take responsibility to recall the products.

The complaint alleged:

“specific products are defective and pose a risk of serious injury or death to consumers and that Amazon is legally responsible to recall them. The named products include 24,000 faulty carbon monoxide detectors that fail to alarm, numerous children’s sleepwear garments that are in violation of the flammable fabric safety standard risking burn injuries to children, and nearly 400,000 hair dryers sold without the required immersion protection devices that protect consumers against shock and electrocution.”

Amazon refused. It sent messages to customers about “potential” safety issues and offered them credits on the website. CPSC argued that was inadequate, and a federal judge agreed.

What followed was a contest to define Amazon’s role in hocking the 60% of its online offering which it doesn’t own, but holds and sells on behalf of third party retailers, taking a 50% cut of their sales in exchange.

Despite collecting $140B in fees last year alone to hold and distribute goods on their behalf, Amazon argued it wasn’t a distributor. Which is stupefying.

As a non-distributor, it therefore had no duty of care to customers with respect to the safety of goods sold on its website. If pajamas caught fire and a child was hurt or died, that would be unfortunate, but not something Amazon had a duty to prevent. So it argued.

No one bought that. Exercising regulatory power it unambiguously possesses, CPSC declared Amazon is, in fact, a distributor. And does, therefore, bear legal responsibility for the recall of unsafe products sold on its website, whether owned or merely fulfilled by Amazon.

Henceforth, Amazon has a duty to assess the safety of what it sells, to have a process to absorb and investigate safety complaints, to make safety determinations, and to conduct recalls of unsafe products. A proper recall generally means customers return or destroy unsafe products in exchange for a refund.

This closes an online retail loophole upon which Amazon’s business model was built. And the financial impact of compliance could be seismic. More than 4.5 billion third-party items were sold on Amazon in the US last year. That’s more than 8,600 every minute.

What’s the cost of assuring safety of those items? What’s the cost of fielding customer safety complaints about those items and how does it square with Amazon’s reduction in customer service staff? What sort of recall rate should be expected and what will that cost?

I don’t know. But if the cost of safety were to absorb just 5% of the volume of third-party sales, that would consume one third of the company’s annual profits.

Amazon grew on the strength of certain unique advantages afford by being an online rather than physical retailer. One of those advantages was the freedom to sell products without warranting their functionality, quality, or safety. The CPSC has removed this advantage, meaning Uncle Jeff’s General Store is now responsible if it sells a battery charger that burns down a house.

Every plastic toy. Every pellet gun. Every climbing harness. Every fire extinguisher. Amazon must underwrite the safety of these products. It must keep records. It must have a process to hear complaints, investigate, and take actions. It must have staff to do all of the above.

And here’s the thing. It should have been doing this stuff all along. Because if you care about safety, then you care. And you take the material measures necessary to assure it from end to end. And if you can’t do that and still make money, then you don’t have a sustainable business model.

Amazon’s value system has been savaged in the past few years. And the damage has been primarily done by Amazon itself. This is another example of failing to keep values relevant as it has scaled.

This one will be costly, and appropriately so.

I’ve tried, with considerable bias but also considerable evidence, reasoning, logic, and theory, to illustrate why I think Amazon is circling the drain while it pretends everything is cool.

Turning your back on the suppliers, customers, employees, and values that made you great is apparently self-defeating. Which makes us wonder what isn’t apparent.

We can rely on large corporations like Amazon to behave rationally most of the time. To do what they perceive to be in their interest, which is usually defined in financial terms.

Amazon seems to be making irrational decisions. Doing things that run contrary to its brand and identity. Sometimes, when things aren’t immediately clear from initial observations, it pays to listen to what’s happening in the background.

Like any good Apocalypse, this one has a backing track. In this case provided by Andy Jassy’s recent RTO announcement, which has made him about as popular with his own people as Attila the Hun. When I listen closely, I hear a symphony of disaster.

The dissonance originates with Jassy’s insistence that getting everyone together in the office is about culture and collaboration. That’s horse feathers.

Pickers in Amazon’s robotics warehouses don’t talk to anyone for most of their ten-hour shift. Tens of thousands of them are physically and emotionally isolated as a condition of employment.

Amazon is no paragon of collaboration. It can’t even be bothered to have a conversation with employees before screwing with their lives.

During my years in Amazon’s operations network, I never participated in or witnessed a major decision based on anything other than data and evidence. Yet, Jassy feels comfortable mandating a return to the office which will crater the lives of thousands of his people without any data to support it. He can’t marshal the data because it doesn’t exist. He could try to persuade contrary to the evidence, but prefers an autocratic edict.

To the extent his edict works, Amazon will succeed in retaining pissed off employees. To the extent it backfires, the company will lose top talent. Even before that verdict comes in, directors and junior VPs are deeply annoyed that the CEO is telling them how to suck eggs.

So why do it? And more importantly, why does the CEO need to be the one doing it?

The clue, as is often the case, is found in previous moves that were more than they seemed.

Just over a year ago, Amazon told employees attached to small regional offices that they needed to move to a main hub. Seattle, Nashville, DC, New York. The rationale supplied for that policy had to do with occupancy rates in corporate offices in those main hubs. Those rates had dipped below 70% after the pandemic with the lurch into hybrid and remote work. Amazon said it was targeting 90% occupancy, a number recently repeated in this latest wave of office ballyhoo.

Occupancy rates. Not culture. Not collaboration. But pumping up occupancy.

Which raises the question, why the Hell does Amazon care about occupancy rates?

From here, I will speculate on an informed basis. I have no choice but to speculate, because Amazon has barricaded the pertinent information behind a dozen walls of legal secrecy under the guise of fiduciary duty.

But I am telling you I am speculating. It’s up to you to decide if there is anything to this, or I am just a crackpot imagining slithering snakes in a drawer full of tube socks.

For Amazon to behave in a way that seems irrational to us means there is an even worse choice to avoid, making its bad choice seem rational by comparison. I believe that worse choice lies in a grimly familiar place: the realm of real estate.

Riches to Rags

In the latter half of the 19th Century, King Ludwig II of Bavaria decided the extravagance of his royal Munich residence was too confining. He sought a retreat where he could honor his reign with an emblem of Wagnerian grandeur.

So he swerved public funding and dumped his entire personal fortune into the construction of Neuschwanstein Castle. Today, it is an irresistible tourist attraction at the northern edge of the Alps, a wondrously beautiful spectacle at the intersection of arrogance and architecture situated in one of the most gorgeous spots in the world.

But Ludwig never saw any of that. He went broke trying to build it. He died before it was finished. In fact, it never was finished.

Ludwig thought his money was inexhaustible. And he sought a monument to mark his existence for the rest of time. Such self-reverence nearly always leads to unfinished castles and broken men. Or in contemporary parlance, bankrupt corporations.

US commercial real estate is in distress. Property values are flat and in some cases declining. This is especially the case in office buildings, and for good reason.

The pandemic exposed a couple of things. First, that physical togetherness is not necessary for teams to do complex work — a proposition ironically advanced and proven by Amazon. Second, that metropolitan commerce is far more dependent on office building occupancy than anyone realized.

During the pandemic, office buildings saw their occupancy rates plummet as companies adapted to the reality of remote work. With that shift, tax receipts dropped and city finances suffered.

Commercial real estate loans don’t work the same as mortgages. Financing runs on a 10-year term, giving banks the flexibility to reassess risk as conditions change, giving landlords the flexibility to change tenants, and giving tenants the opportunity to scale up, down, or out of their property obligations according to business need.

But this means commercial real estate is volatile. Interest rate fluctuations can create havoc for everyone involved. Interest rates on commercial real estate loans are today 2 points higher than they were a decade ago.

Now consider that Amazon spent $4-5B to build its two headquarters buildings in Seattle in 2015/16. Almost certainly it will need to refinance those loans in the next couple of years.

When that refinancing window opens, two things will determine Amazon’s real estate bill. Interest rates, and the value placed on the buildings. The latter will be driven almost entirely by occupancy rates.

So the answer to “why does Amazon care about occupancy rates” is that by driving those rates up, it can maximize the valuation of its properties, decrease to loan-to-value ratio of its financing, and secure the best interest rate possible.

The size of the prize is massive.

One point of difference in the interest rate attached to a commercial loan across a 10-year term equates to $100M in interest payments. Given Amazon will need to refinance several billion in commercial real estate over the next few years, the stakes of increasing occupancy could have a billion dollar price tag. Way more than the cost of pissing off employees. Way more than hiring to replace those who quit.

But wait. There’s more.

Amazon has received somewhere in the neighborhood of $5-6B in government subsidies to develop its offices in cities like Seattle, Arlington, Nashville, and New York. Those subsidies and tax breaks are contingent on maintaining occupancy. And this makes sense. Cities want their business districts to thrive. They want footfall, rent, and coffee grinding en masse. They want Amazonians spending money, generating revenue for downtown businesses, and paying taxes.

If Amazon defies its occupancy promises, the costs could be both financial and perceptual. It could be repaying subsidies while getting savaged in the media, a convenient punching bag for politicians who need someone to blame for financial rot and decrepitude in their urban zones.

When you consider all of that, Amazon is being rational if it chooses to alienate employees instead of empowered banks and politicians. Especially in light of the other pressures on its business model illustrated herein.

Liars, Damn Liars, and Executives

If I am right, why wouldn’t Amazon just level with employees? Why not enlist their help raising occupancy and revitalizing city centers where it operates?

Well, many reasons. But two that stand out.

First, it would expose to investors the company’s strategic intemperance. Like King Ludwig, it has bet the farm on cathedral-building, which has contributed to a massive erosion of decision space.

Such an admission might harm investor and shareholder confidence, putting a dent in share price. It could create political antagonism in some quarters as it tries to defuse it in others. Shining a bunch of sunlight on sweetheart tax deals paid for by an entire electorate but directly benefiting a relatively small subgroup would do Amazon’s political bedfellows no favors.

As it usually does, the truth would raise a lot of questions, and answering questions is one thing CEOs avoid like the plague.

Second, it would hand Amazon employees leverage. If the company needs them back in the office, they will want to extract concessions for going along. Like better pay. Like relocation and commuting allowances. Like childcare subsidies and/or facilities. Like reforms to talent reviews to provide more transparency and less coercion.

Jassy isn’t about to hand this kind of power to employees. It’s both easier and cheaper to concoct a premise that situates the locus of blame and responsibility for improvement on their shoulders.

A company that will turn its back on everything that made it great isn’t built to survive, much less last. A company whose employees think their execs are wearing clown shoes is on borrowed time.

And a company fighting a multi-front battle with agencies, regulators, employees, customers, and the general public is going to have its perimeter breached. Once opponents are inside that perimeter, you have to shoot in the direction of your own team to target the enemy. Soon, you’re killing your own value creation.

And that’s when the end is nigh. The battle is lost. It’s all over but the cryin’.

And that’s where I think we are with Amazon.

The business model is reliant on a clutch of invalid assumptions. And it seems like avoiding that reality is preferred to facing it. The only question is how far Amazon’s executives will stretch to conceal the nature of its predicament to keep the money flowing.

Soon, it will no longer be possible to conceal the true nature of this situation.

A few hundred billion in legal exposure. New safety requirements measured in the billions. A broken relationship with its supplier base. A toxic relationship with its own workforce, which is now giving in to antagonism and being courted by unions. Customers realizing they’re nothing but a cash cow. Executives hemmed into a box by prior decisions, now unable to do what they ought and stuck doing what they can. Not only that, stuck being opaque about it to protect share price.

When this situation becomes undeniable, the company will be pulled from orbit, and capitulation will be rapid.

Or, I could be wrong.

There’s a wonderful scene in the movie Lincoln. It’s about a parrot who wakes up every day and predicts the end of the world. One day, the owner shoots and kills the parrot, making its prediction true.

Predictions are cheap. It costs me nothing to predict Amazon is nearer the end than the beginning, and in fact traipsing through Day 3 oblivious to its zombification.

But ignoring predictions can be hazardous. Few predicted Amazon’s share price would quadruple in three years a decade ago. Few predicted its explosive growth and pandemic heroism would so rapidly give way to Day 2 stasis and decline.

Even fewer predicted that the assumptions in its business model would become invalid in rapid succession, accelerating it into Day 3. Most don’t acknowledge that idea even now.

And almost no one predicts this lumbering Goliath will soon collapse under its own weight. It wasn’t mentioned in Dave Grohl’s stage banter during the private Foo Fighters concert for senior leaders thrown just few months after everyone else’s celebration budgets were basically zeroed.

But eventually the parrot is right. Because everything ends. Sometimes before we ever would have expected.

TC is a former Amazon general manager and accomplished operations leader with three decades of leadership experience in private and public organizations.

I work there now, and there definitely is a feeling of unease in the air. Also have seen some pretty sloppy accounting and focus on boosting net income on paper. Had seemed very desperate when I ran across it. Now I can see what’s driving it. Very insightful article. Thank you!

As a 10-year tenured corporate Amazonian, I can say this is all plausible. I've moved between the company's retail, transportation, and now a moonshot team and all of Jassy's latest announcements and the messaging passed down through his SVPs signal an existential threat that leadership is taking very seriously.